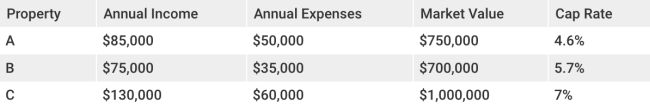

what is a good cap rate 5.25

One rule of thumb in regards to cap rate: Good neighborhoods tend to have lower cap rates, while poorer areas are more likely to trade at higher caps. It's generally safe to assume that the 15% cap rate property you find is not in a great place.